Calendar Tax Year - The tax period begins on july 1 and ends the following june 30. Generally, taxpayers filing a version of form 1040 use the calendar year. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. The choice is made easy but its intuitiveness and tends to line up. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. You must pay the full year's tax on all vehicles you have in use during the month of july. 31 and includes taxes owed on earnings during. In the u.s., the tax year for individuals runs from jan.

You must pay the full year's tax on all vehicles you have in use during the month of july. The choice is made easy but its intuitiveness and tends to line up. In the u.s., the tax year for individuals runs from jan. Generally, taxpayers filing a version of form 1040 use the calendar year. The tax period begins on july 1 and ends the following june 30. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. 31 and includes taxes owed on earnings during.

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. The tax period begins on july 1 and ends the following june 30. Generally, taxpayers filing a version of form 1040 use the calendar year. You must pay the full year's tax on all vehicles you have in use during the month of july. 31 and includes taxes owed on earnings during. The choice is made easy but its intuitiveness and tends to line up. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. In the u.s., the tax year for individuals runs from jan.

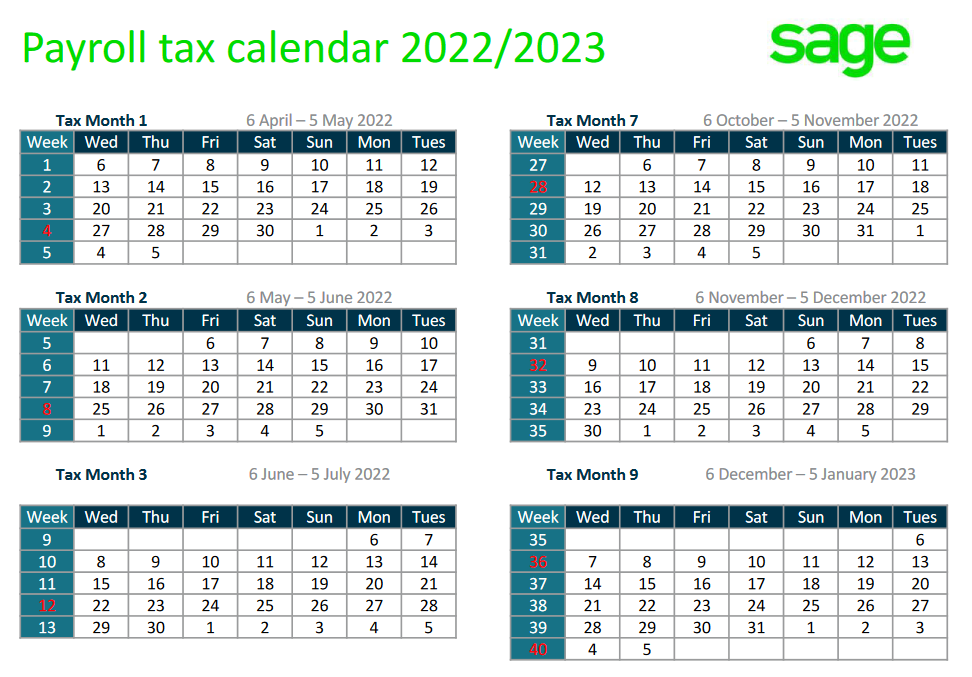

Power Apps Guide Dates How to calculate UK tax weeks Power Apps

The tax period begins on july 1 and ends the following june 30. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. In the u.s., the tax year for individuals runs from jan. Generally, taxpayers filing a version of form 1040 use the calendar year..

New Year Tax Planning Ideas McIntyreStuart

The tax period begins on july 1 and ends the following june 30. In the u.s., the tax year for individuals runs from jan. 31 and includes taxes owed on earnings during. You must pay the full year's tax on all vehicles you have in use during the month of july. An individual can adopt a fiscal year if the.

Take Hmrc Tax Year Calendar 2021 Best Calendar Example

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. 31 and includes taxes owed on earnings during. The choice is made easy but its intuitiveness and tends to line up. The tax period begins on july 1 and ends the following june 30. It is common.

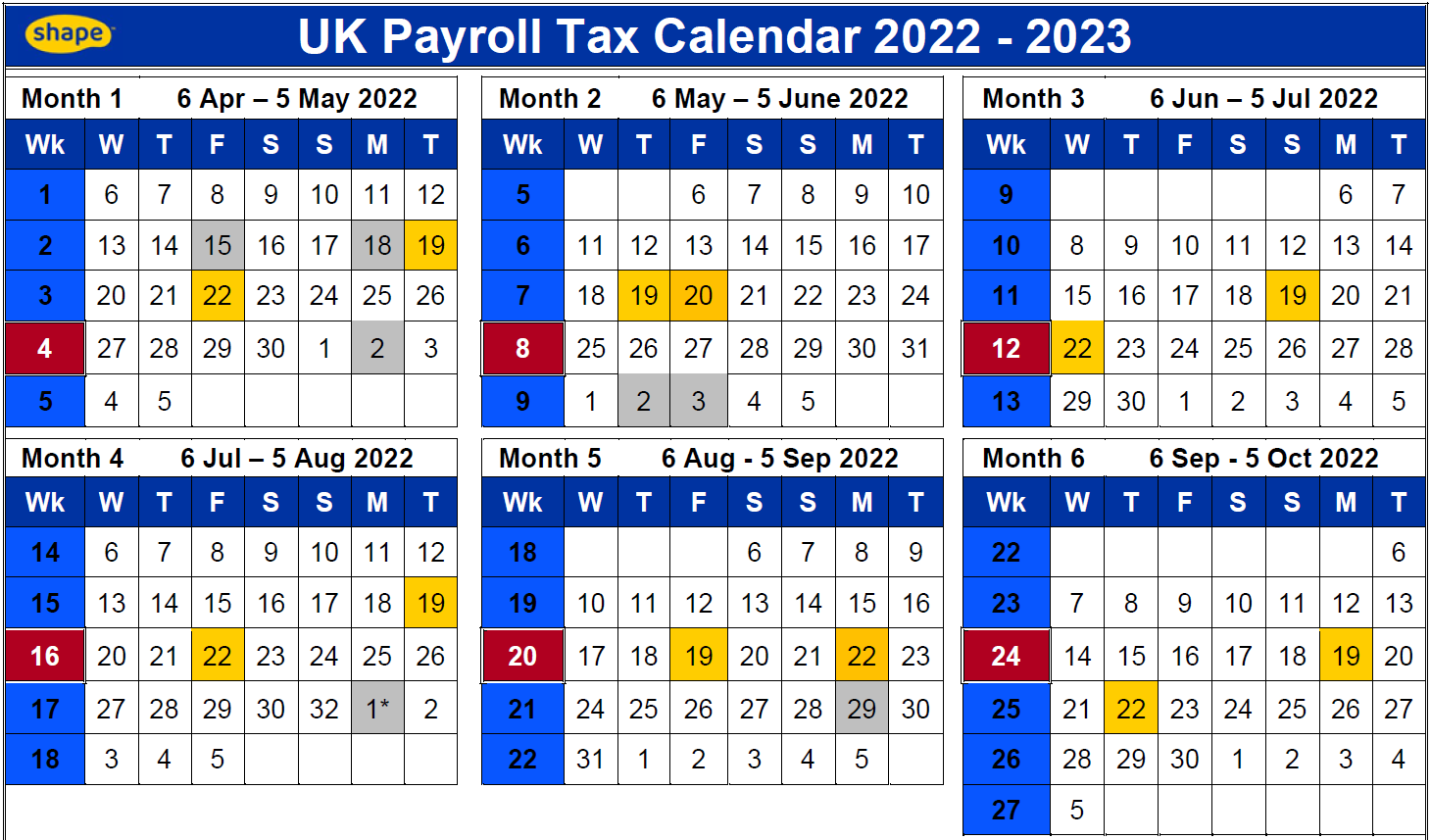

UK Payroll Tax Calendar 20222023 Shape Payroll

It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. The tax period begins on july 1 and ends the following june 30. You must pay the full year's tax on all vehicles you have in use during the month of july. The choice is made.

Tax Calendar CM Advocates LLP

The tax period begins on july 1 and ends the following june 30. In the u.s., the tax year for individuals runs from jan. You must pay the full year's tax on all vehicles you have in use during the month of july. Generally, taxpayers filing a version of form 1040 use the calendar year. An individual can adopt a.

Comprehensive Tax Compliance Calendar for FY 202223 Covering Important

In the u.s., the tax year for individuals runs from jan. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. You must pay the full year's tax on all vehicles you have in use during the month of july. It is common for organizations to use.

Tax Week Calendar 2024/24 Uk Printable 202425 Risa Raynell

You must pay the full year's tax on all vehicles you have in use during the month of july. In the u.s., the tax year for individuals runs from jan. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Generally, taxpayers filing a version of.

Choosing between a calendar tax year and a fiscal tax year Seiler

31 and includes taxes owed on earnings during. The tax period begins on july 1 and ends the following june 30. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Generally, taxpayers filing a version of form 1040 use the calendar year. An individual can.

Today is the Deadline for filing 990 Series Returns! Need an Extension

The choice is made easy but its intuitiveness and tends to line up. Generally, taxpayers filing a version of form 1040 use the calendar year. You must pay the full year's tax on all vehicles you have in use during the month of july. The tax period begins on july 1 and ends the following june 30. 31 and includes.

Tax Return 2023 Chart Printable Forms Free Online

It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. 31 and includes taxes owed on earnings during. The choice is made easy but its intuitiveness and tends to line up. In the u.s., the tax year for individuals runs from jan. You must pay the.

In The U.s., The Tax Year For Individuals Runs From Jan.

31 and includes taxes owed on earnings during. You must pay the full year's tax on all vehicles you have in use during the month of july. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. The choice is made easy but its intuitiveness and tends to line up.

The Tax Period Begins On July 1 And Ends The Following June 30.

An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted. Generally, taxpayers filing a version of form 1040 use the calendar year.