Business Disclosure Form - Need to file a boir? The corporate transparency act requires most llcs and business entities to file a boi report. Go to the help section in the blue. To avoid penalties, entities that existed before. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Companies that are required to comply (“reporting companies”) must file their initial. Annual statement of beneficial ownership of securities general instructions to form 5: General instructions to form 4: Need to file another type of bsa report?

General instructions to form 4: Filing is simple, secure, and free of charge. Annual statement of beneficial ownership of securities general instructions to form 5: The corporate transparency act requires most llcs and business entities to file a boi report. Need to file a boir? Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. To avoid penalties, entities that existed before. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Many companies are required to report information to fincen about the individuals who ultimately own or control them.

1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. General instructions to form 4: Need to file another type of bsa report? Annual statement of beneficial ownership of securities general instructions to form 5: To avoid penalties, entities that existed before. Filing is simple, secure, and free of charge. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. The corporate transparency act requires most llcs and business entities to file a boi report. Need to file a boir?

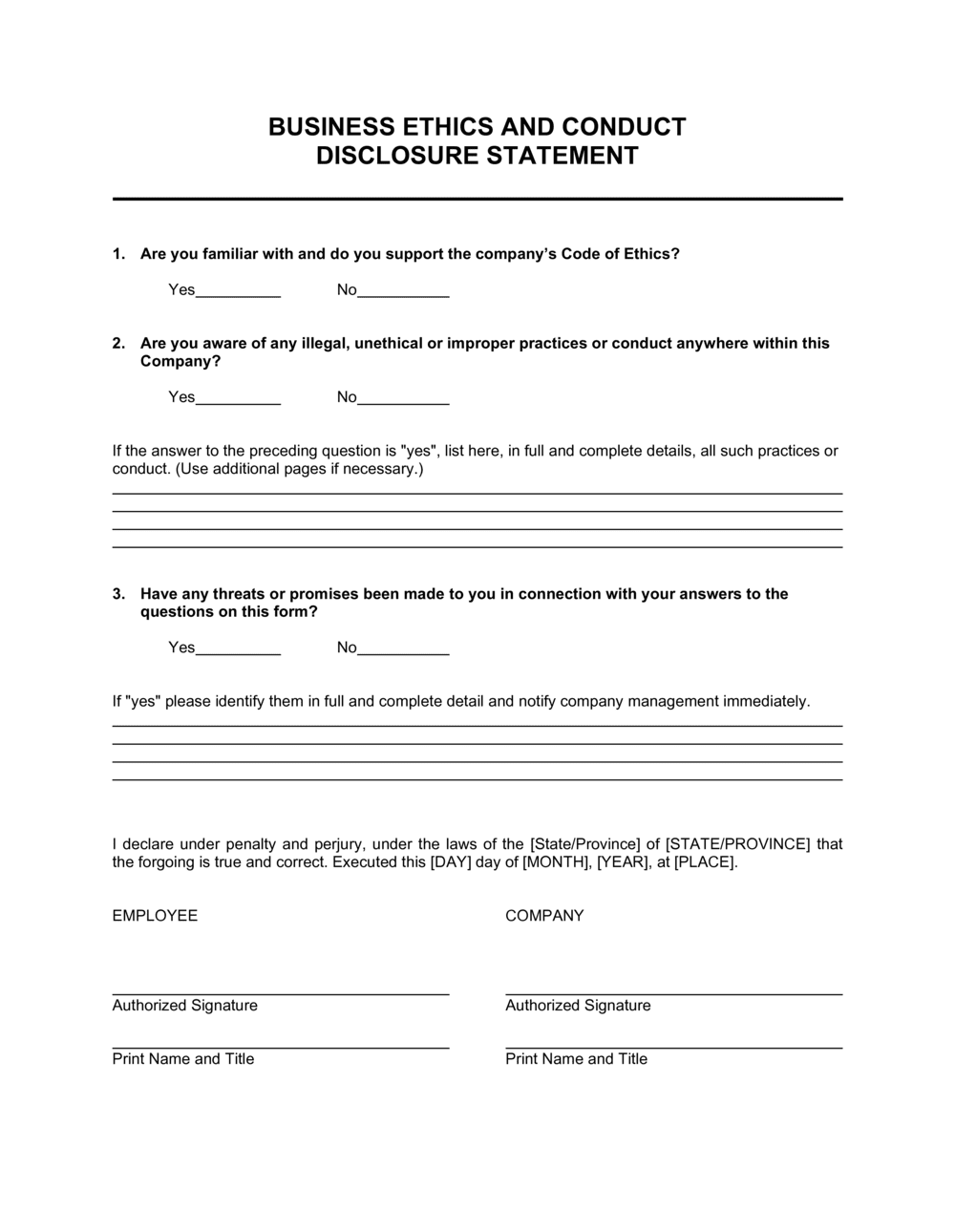

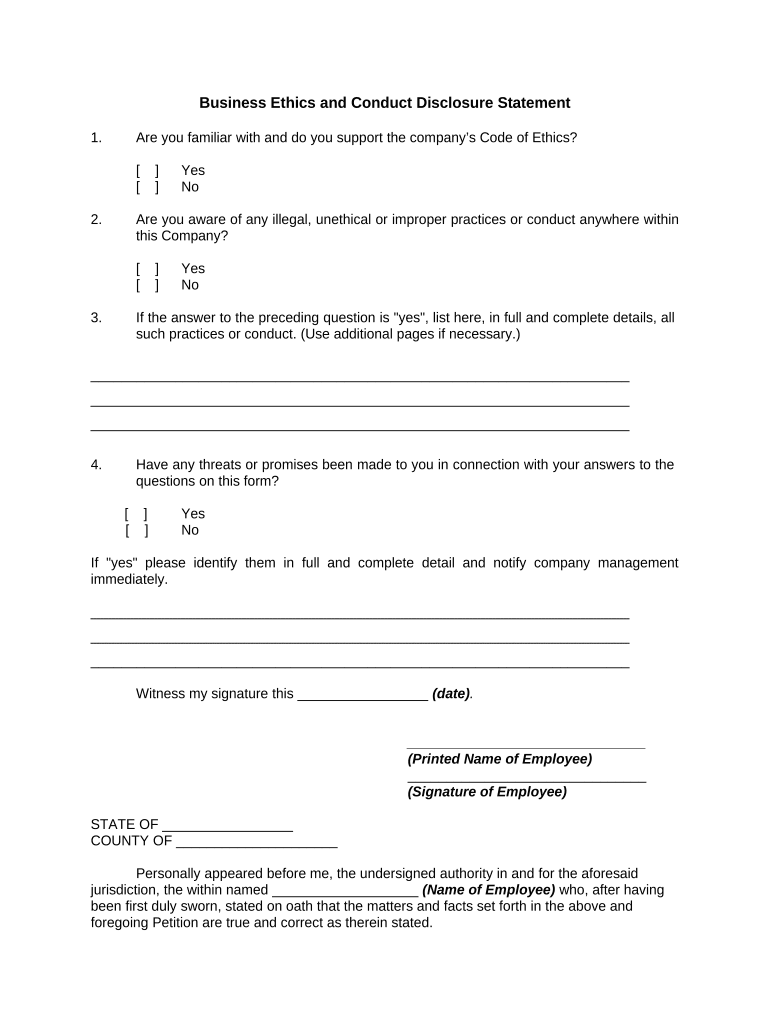

Business Ethics and Conduct Disclosure Statement Template (Download)

Filing is simple, secure, and free of charge. Companies that are required to comply (“reporting companies”) must file their initial. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. Go to the help section in the blue. Need to file another type of bsa report?

Disclosure Face Template

Annual statement of beneficial ownership of securities general instructions to form 5: To avoid penalties, entities that existed before. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. The corporate transparency.

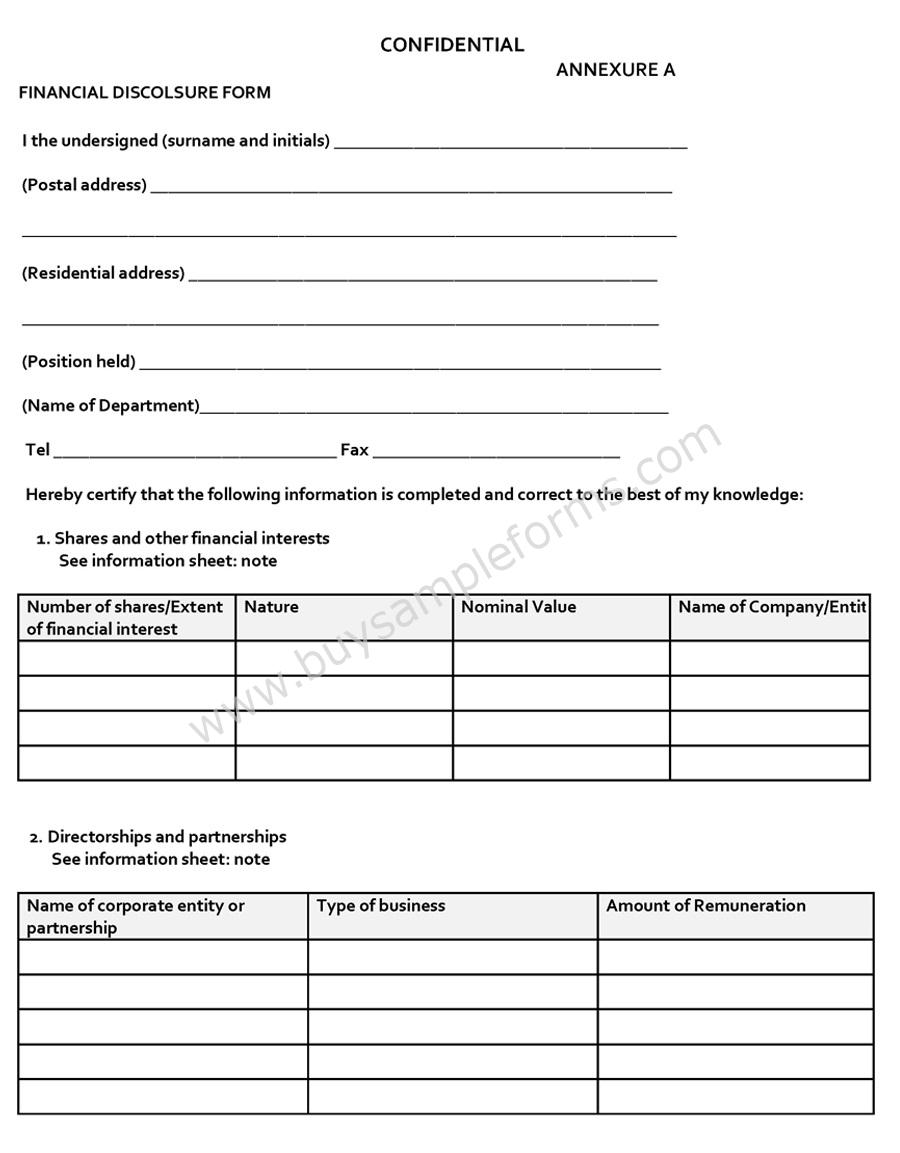

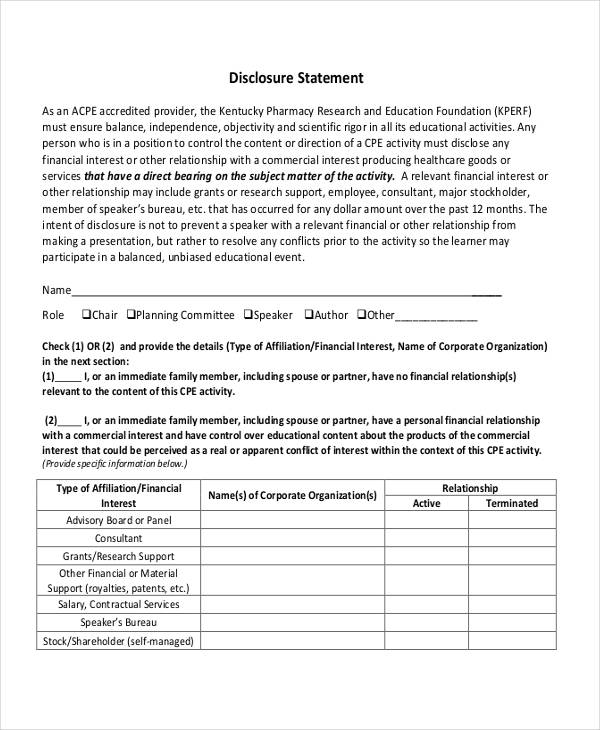

Financial Disclosure Form Sample Forms

Many companies are required to report information to fincen about the individuals who ultimately own or control them. General instructions to form 4: Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. Need to file a boir? To avoid penalties, entities that existed before.

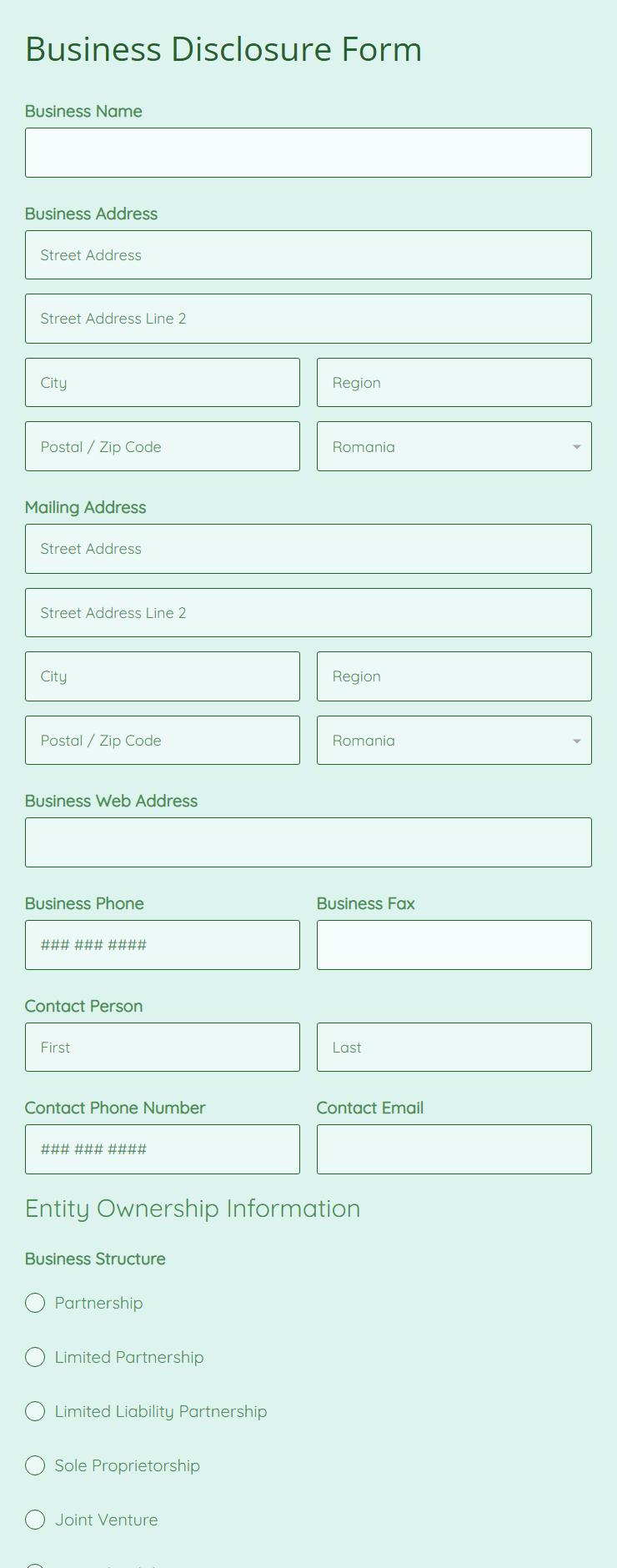

Business Disclosure Form Sample Complete with ease airSlate SignNow

1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Companies that are required to comply (“reporting companies”) must file their initial. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Under the act, small businesses across the united states need to file.

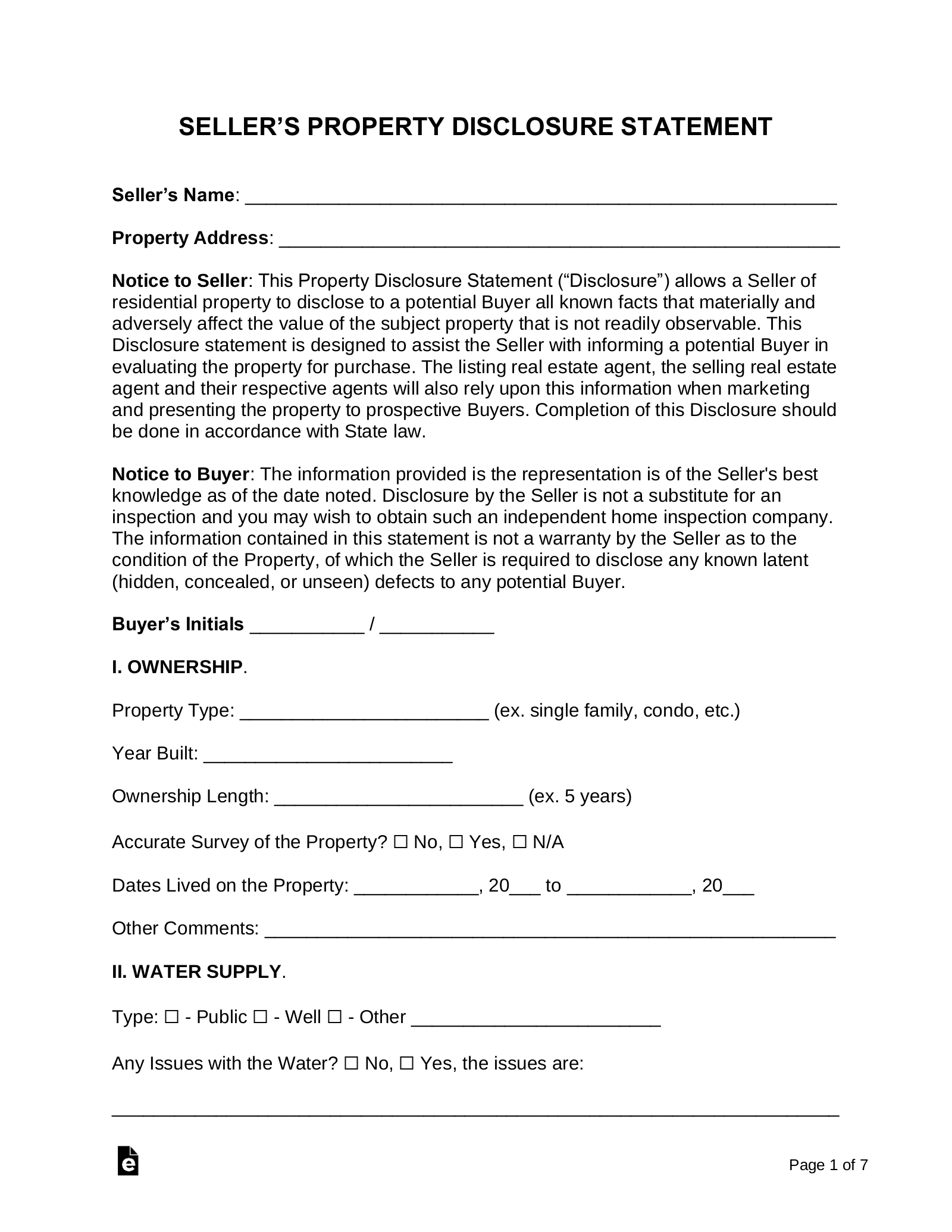

Maine Seller S Property Disclosure Form Fillable Free Printable Forms

To avoid penalties, entities that existed before. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. Companies that are required to comply (“reporting companies”) must file their initial. Filing is simple, secure, and free of charge. When creating an outside business activity (“oba”) disclosure form, it's important to understand.

Disclosure Statement 7+ Examples, Format, How to Write, PDF

Companies that are required to comply (“reporting companies”) must file their initial. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Need to file another type of bsa report? Need to file a.

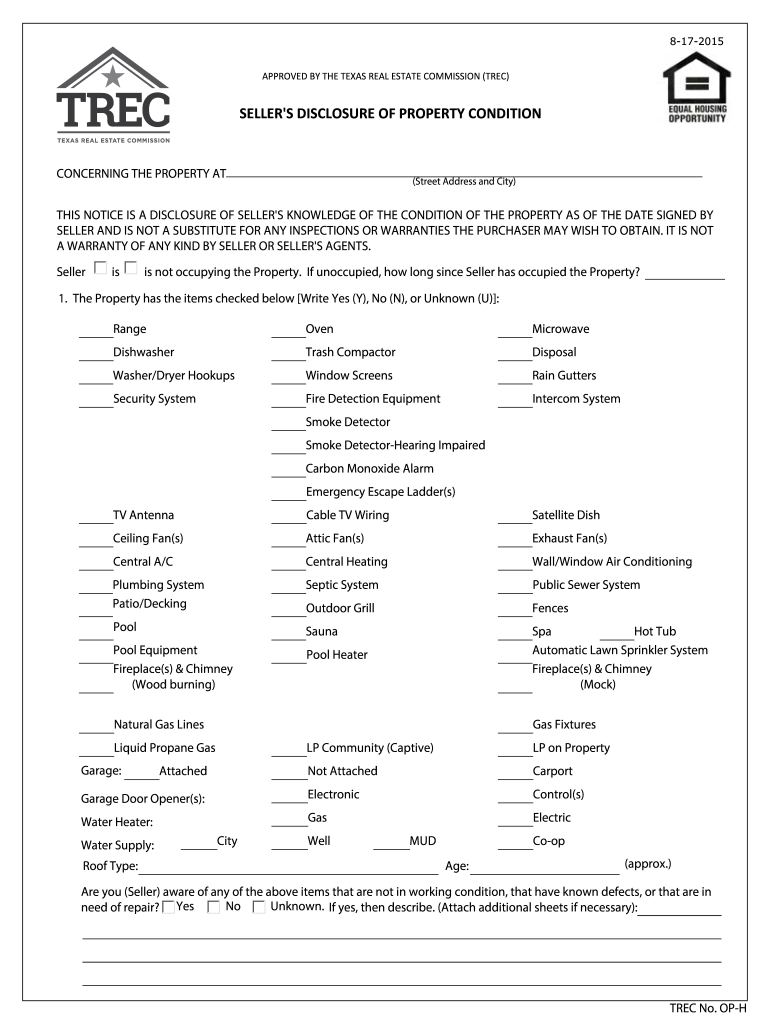

Texas Real Estate Fillable Seller S Disclosure Form Printable Forms

Many companies are required to report information to fincen about the individuals who ultimately own or control them. To avoid penalties, entities that existed before. Need to file a boir? Companies that are required to comply (“reporting companies”) must file their initial. General instructions to form 4:

seller property disclosure statment Real estate forms, Legal forms

To avoid penalties, entities that existed before. Need to file a boir? Many companies are required to report information to fincen about the individuals who ultimately own or control them. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. 1, 2024, many businesses will be required to report beneficial.

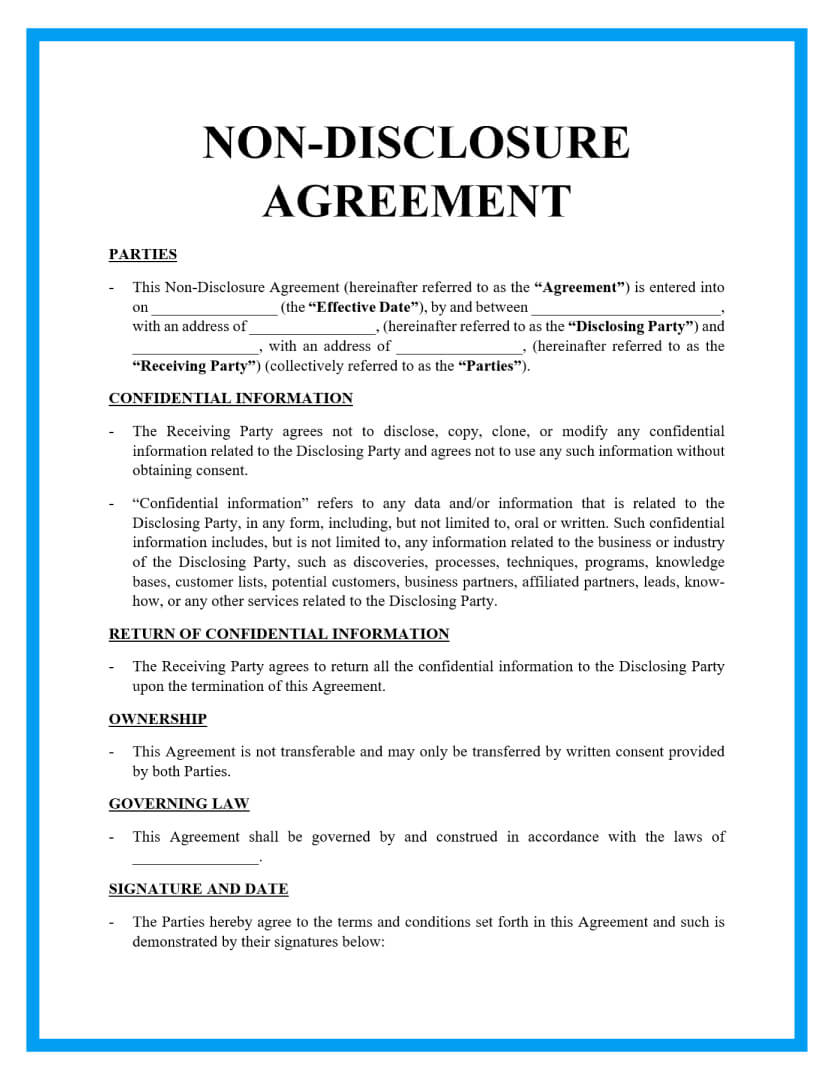

Free Printable Attorney Confidentiality Agreement Form Printable

Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. Companies that are required to comply (“reporting companies”) must file their initial. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. The corporate transparency act requires most llcs and business entities.

Where is Affiliated Business Arrangement Disclosure for eXp Realty in

The corporate transparency act requires most llcs and business entities to file a boi report. Go to the help section in the blue. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Need to file another type of bsa report? Filing is simple, secure, and free of charge.

General Instructions To Form 4:

When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Companies that are required to comply (“reporting companies”) must file their initial. The corporate transparency act requires most llcs and business entities to file a boi report. Many companies are required to report information to fincen about the individuals who ultimately own or control them.

Go To The Help Section In The Blue.

To avoid penalties, entities that existed before. Filing is simple, secure, and free of charge. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network.

Need To File A Boir?

Annual statement of beneficial ownership of securities general instructions to form 5: Need to file another type of bsa report?