Arizona Tax Forms 140 - Personal income tax return filed by resident taxpayers. 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. 24 rows personal income tax return filed by resident taxpayers. You may file form 140 only if you (and your spouse, if married filing a joint return) are. You may file form 140 only if you (and your spouse, if married filing a joint. Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or.

26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. 24 rows personal income tax return filed by resident taxpayers. You may file form 140 only if you (and your spouse, if married filing a joint return) are. Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. Personal income tax return filed by resident taxpayers. You may file form 140 only if you (and your spouse, if married filing a joint.

Personal income tax return filed by resident taxpayers. Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. You may file form 140 only if you (and your spouse, if married filing a joint. 24 rows personal income tax return filed by resident taxpayers. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. You may file form 140 only if you (and your spouse, if married filing a joint return) are.

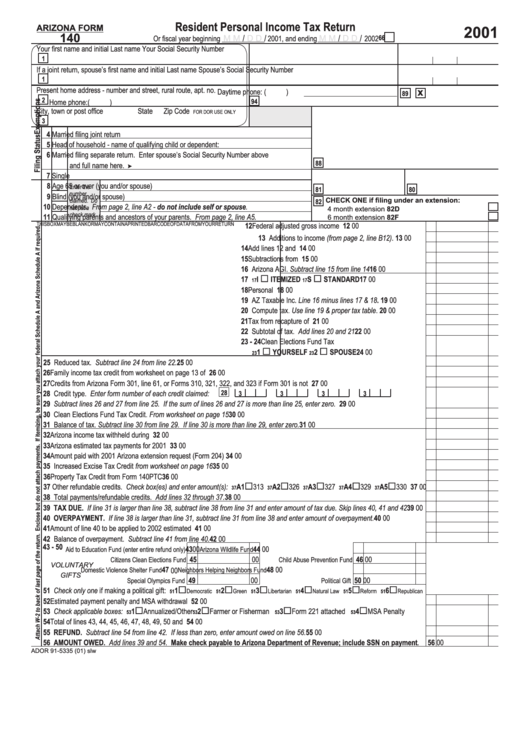

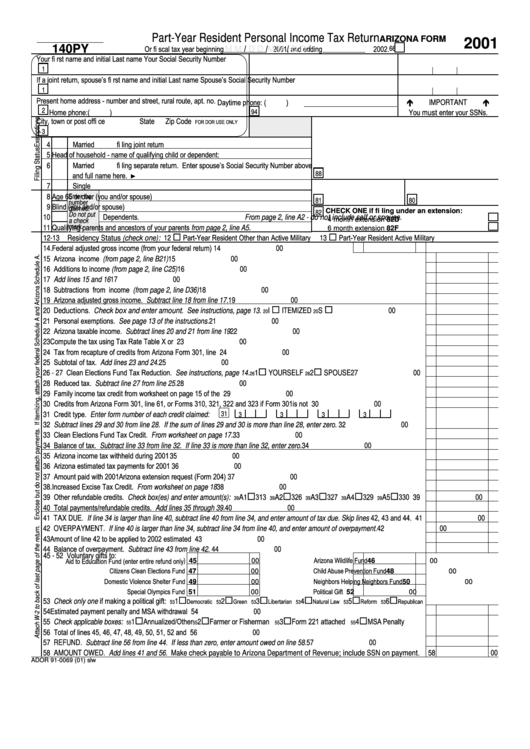

Arizona Form 140 Resident Personal Tax Return 2001 printable

26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona.

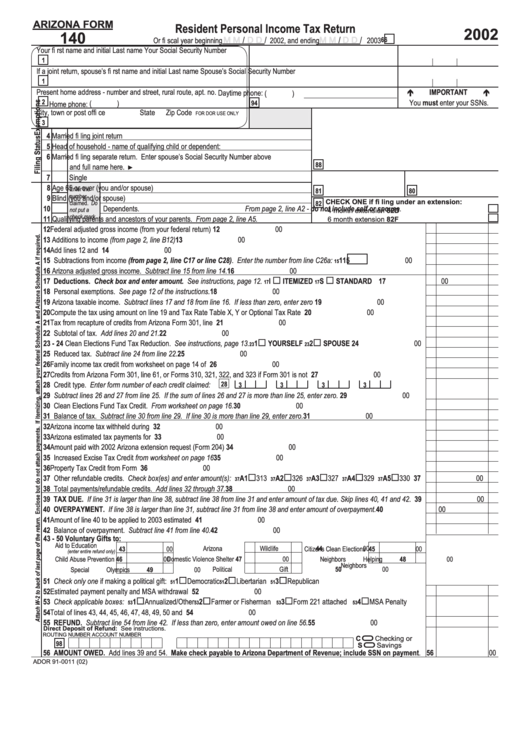

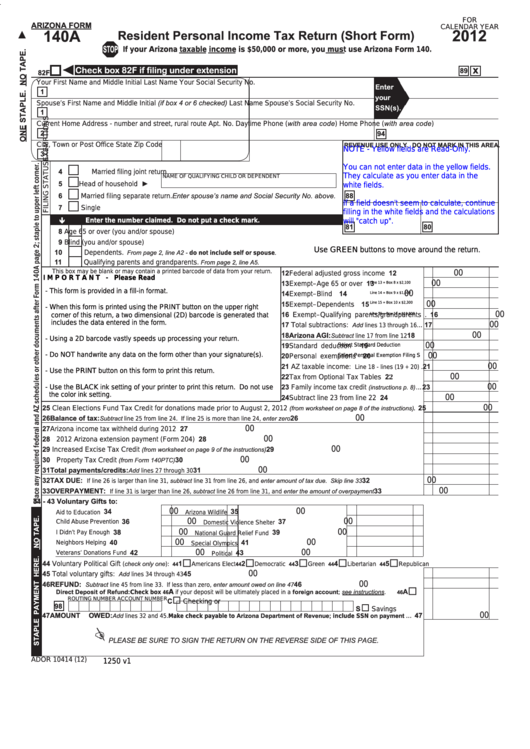

Fillable Arizona Form 140 Resident Personal Tax Return 2002

Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. You may file form 140 only if you (and your spouse,.

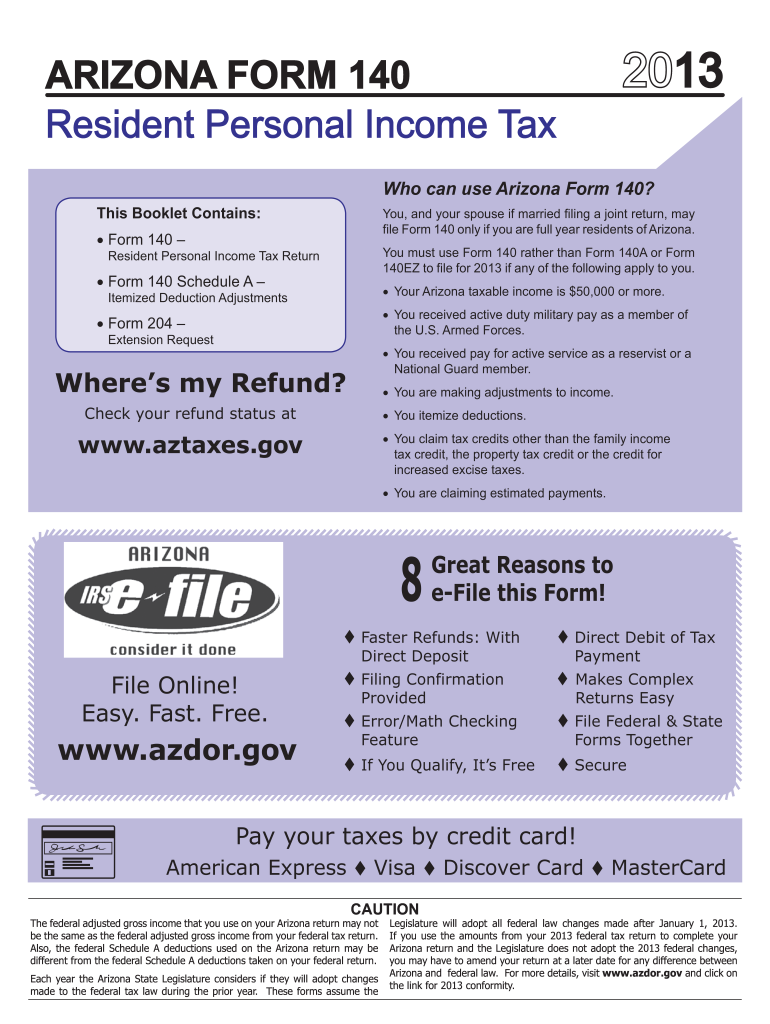

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

You may file form 140 only if you (and your spouse, if married filing a joint return) are. 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. You may file form 140 only if you (and your spouse, if married filing a joint. Personal income tax return filed by resident.

What You Need to Know about Arizona's New 2.5 Flat Tax Rate Hourly, Inc.

You may file form 140 only if you (and your spouse, if married filing a joint. Personal income tax return filed by resident taxpayers. 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under.

Arizona tax Fill out & sign online DocHub

You may file form 140 only if you (and your spouse, if married filing a joint. You may file form 140 only if you (and your spouse, if married filing a joint return) are. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or..

Az Fillable Tax Forms Printable Forms Free Online

Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. You may file form 140 only if you (and your spouse, if married filing a joint. Personal income tax return filed by resident taxpayers. January 1, 2023 through december 31, 2023 for which you are claiming an.

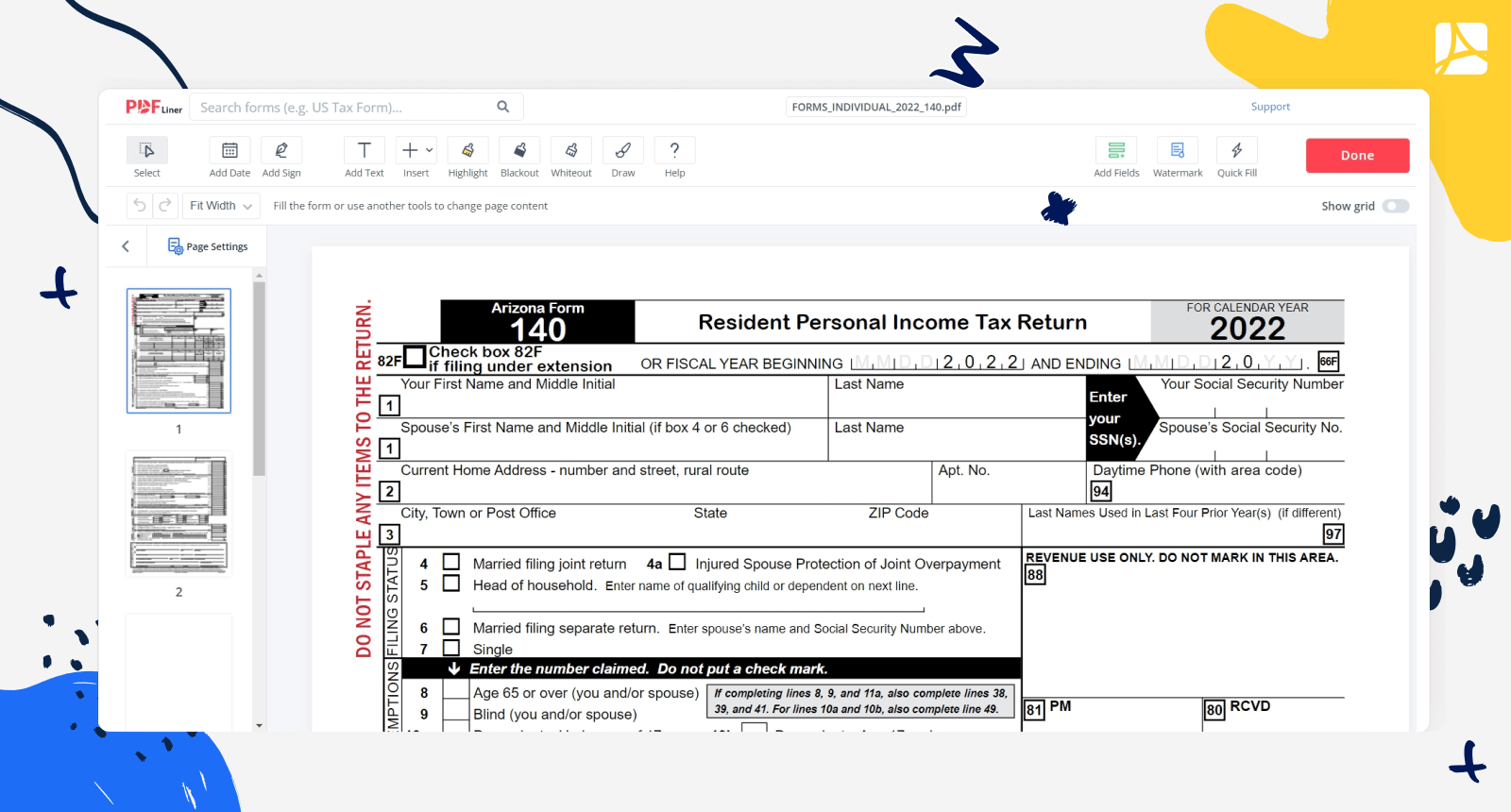

Arizona Form 140 (2023), edit and sign form PDFLiner

January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. 24 rows personal income tax return filed by resident taxpayers. You.

2021 AZ Form 140X Fill Online, Printable, Fillable, Blank pdfFiller

January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. You may file form 140 only if you (and your spouse, if married filing a joint. You may file form 140 only if you (and your spouse, if married filing a joint return) are..

Az Form 140 Py PartYear Resident Personal Tax Return 2001

26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. 24 rows personal income tax return filed by resident taxpayers. Personal income tax return filed.

Arizona Fillable Form 140 Printable Forms Free Online

You may file form 140 only if you (and your spouse, if married filing a joint. January 1, 2023 through december 31, 2023 for which you are claiming an arizona tax credit under arizona law for the current tax year return or. 24 rows personal income tax return filed by resident taxpayers. Personal income tax return filed by resident taxpayers..

January 1, 2023 Through December 31, 2023 For Which You Are Claiming An Arizona Tax Credit Under Arizona Law For The Current Tax Year Return Or.

Taxpayers electing to take the standard deduction on their arizona tax return may the standard deduction increase amount by 25% (.25) of the. You may file form 140 only if you (and your spouse, if married filing a joint return) are. 24 rows personal income tax return filed by resident taxpayers. Personal income tax return filed by resident taxpayers.

26 Rows Remember, The Starting Point Of The Arizona Individual Income Tax Return Is The Federal Adjusted Gross Income.

You may file form 140 only if you (and your spouse, if married filing a joint.