A Major Advantage Of The Corporate Form Of Ownership Is - Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Ownership of a corporation is shown in shares, which are transferable. • has the ability to raise more. A major advantage of the corporate form of ownership is: There are 2 steps to solve this one. Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. Shareholders may dispose of part or all of their interest by.

Shareholders may dispose of part or all of their interest by. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? A major advantage of the corporate form of ownership is: Ownership of a corporation is shown in shares, which are transferable. There are 2 steps to solve this one. • has the ability to raise more. Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are.

Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. There are 2 steps to solve this one. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Ownership of a corporation is shown in shares, which are transferable. • has the ability to raise more. Shareholders may dispose of part or all of their interest by. A major advantage of the corporate form of ownership is:

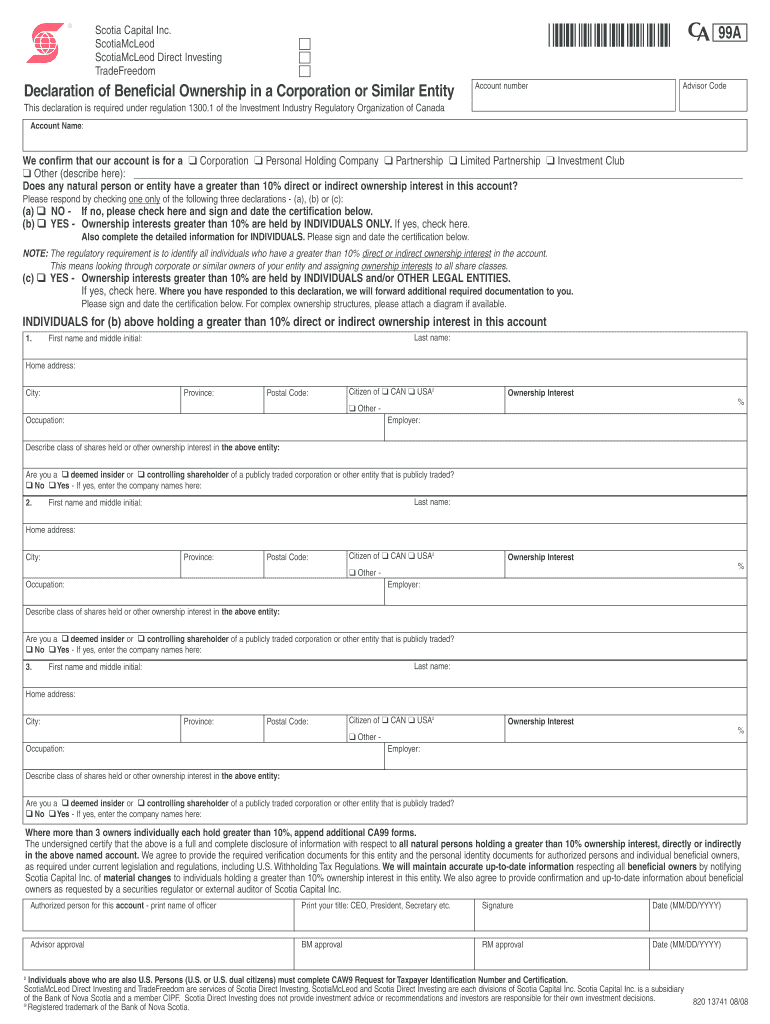

Corporate Ownership Structures Fill Online, Printable, Fillable

Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. • has the ability to raise more. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Shareholders may dispose of part or all of their interest by. A major advantage.

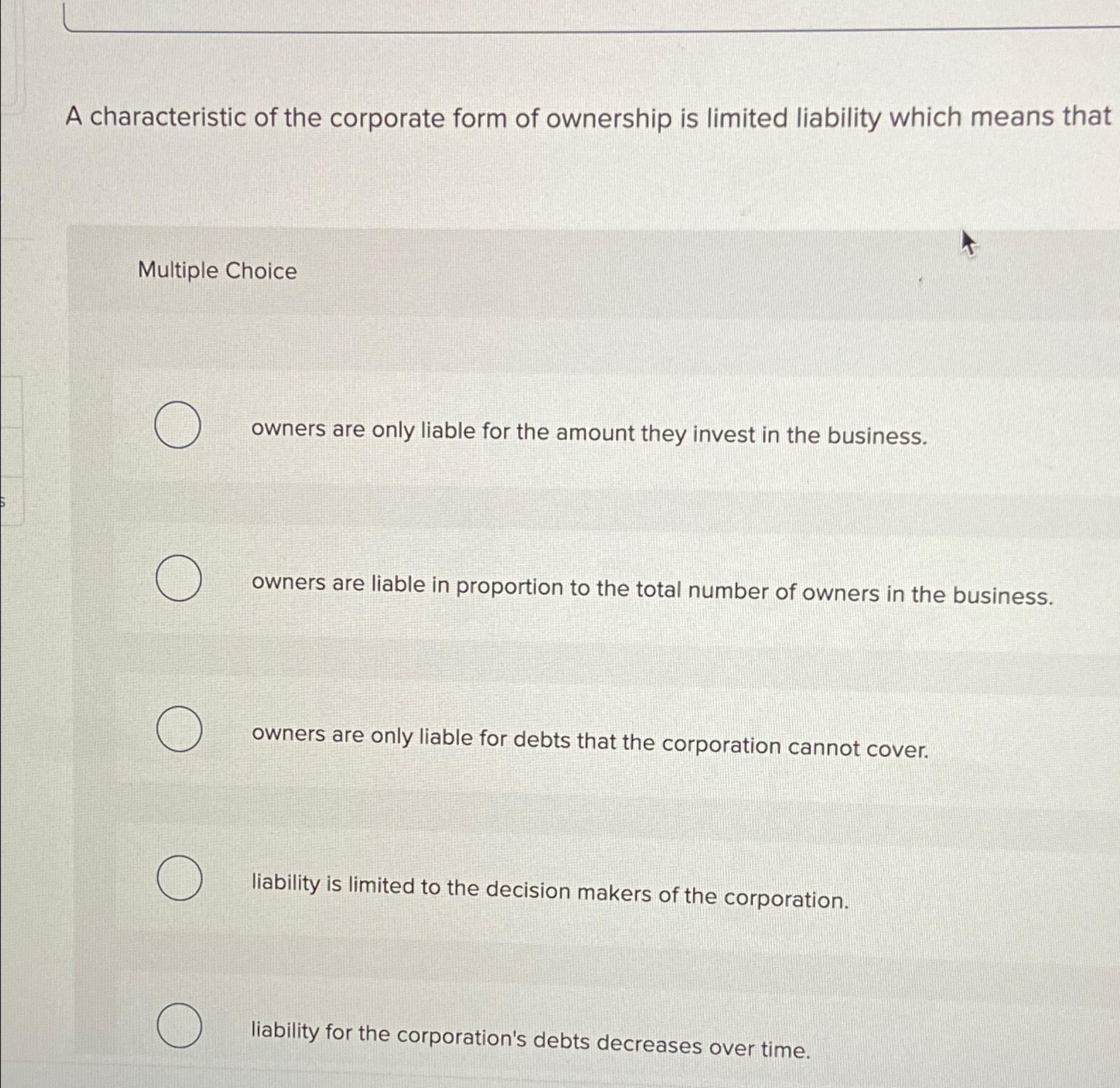

Solved A characteristic of the corporate form of ownership

Shareholders may dispose of part or all of their interest by. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Ownership of a corporation is shown in shares, which are transferable. • has the ability to raise more. Study with quizlet and memorize flashcards containing terms like what is a major advantage.

Notarized Letter From Property Owner Fill Online, Printable, Fillable

Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. A major advantage of the corporate form of ownership is: There are 2 steps to solve this one. • has the.

17 Advantages and Disadvantages of Sole Proprietorship CareerCliff

Ownership of a corporation is shown in shares, which are transferable. Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? A major advantage of the corporate form of ownership is:.

Declaration of Company Ownership Sample Form Fill Out and Sign

• has the ability to raise more. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. There are 2 steps to solve this one. A major advantage of the corporate.

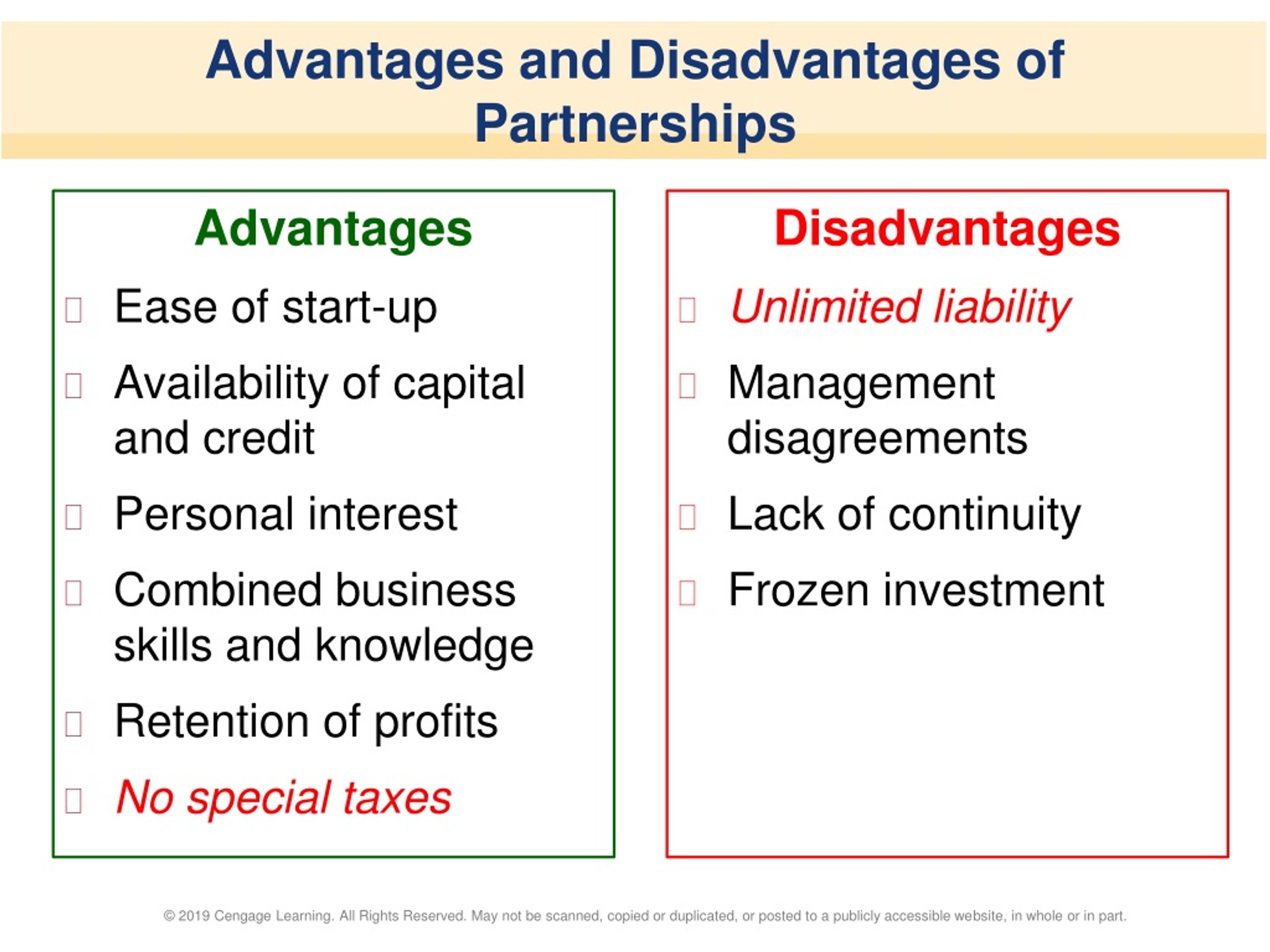

Advantages and disadvantages of two types of ownership structures

• has the ability to raise more. A major advantage of the corporate form of ownership is: Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. There are 2 steps to solve this one. Ownership of a corporation is shown in shares, which are transferable.

Securing Competitive Advantage through Employee Ownership

Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. Shareholders may dispose of part or all of their interest by. There are 2 steps to solve this one. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? Ownership of.

What Are The Major Benefits Of Business Ownership? in 2020 Business

Ownership of a corporation is shown in shares, which are transferable. • has the ability to raise more. A major advantage of the corporate form of ownership is: Study with quizlet and memorize flashcards containing terms like what is a major advantage of the corporate form of business?, what are. Compared to a sole proprietorship, which of the following is.

PPT Chapter 11 PowerPoint Presentation, free download ID1669634

Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? A major advantage of the corporate form of ownership is: Ownership of a corporation is shown in shares, which are transferable. • has the ability to raise more. There are 2 steps to solve this one.

Advantages And Disadvantages Of Partnership Business mores.pics

There are 2 steps to solve this one. A major advantage of the corporate form of ownership is: Shareholders may dispose of part or all of their interest by. • has the ability to raise more. Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership?

Study With Quizlet And Memorize Flashcards Containing Terms Like What Is A Major Advantage Of The Corporate Form Of Business?, What Are.

Compared to a sole proprietorship, which of the following is considered an advantage of a general partnership? There are 2 steps to solve this one. A major advantage of the corporate form of ownership is: Ownership of a corporation is shown in shares, which are transferable.

• Has The Ability To Raise More.

Shareholders may dispose of part or all of their interest by.