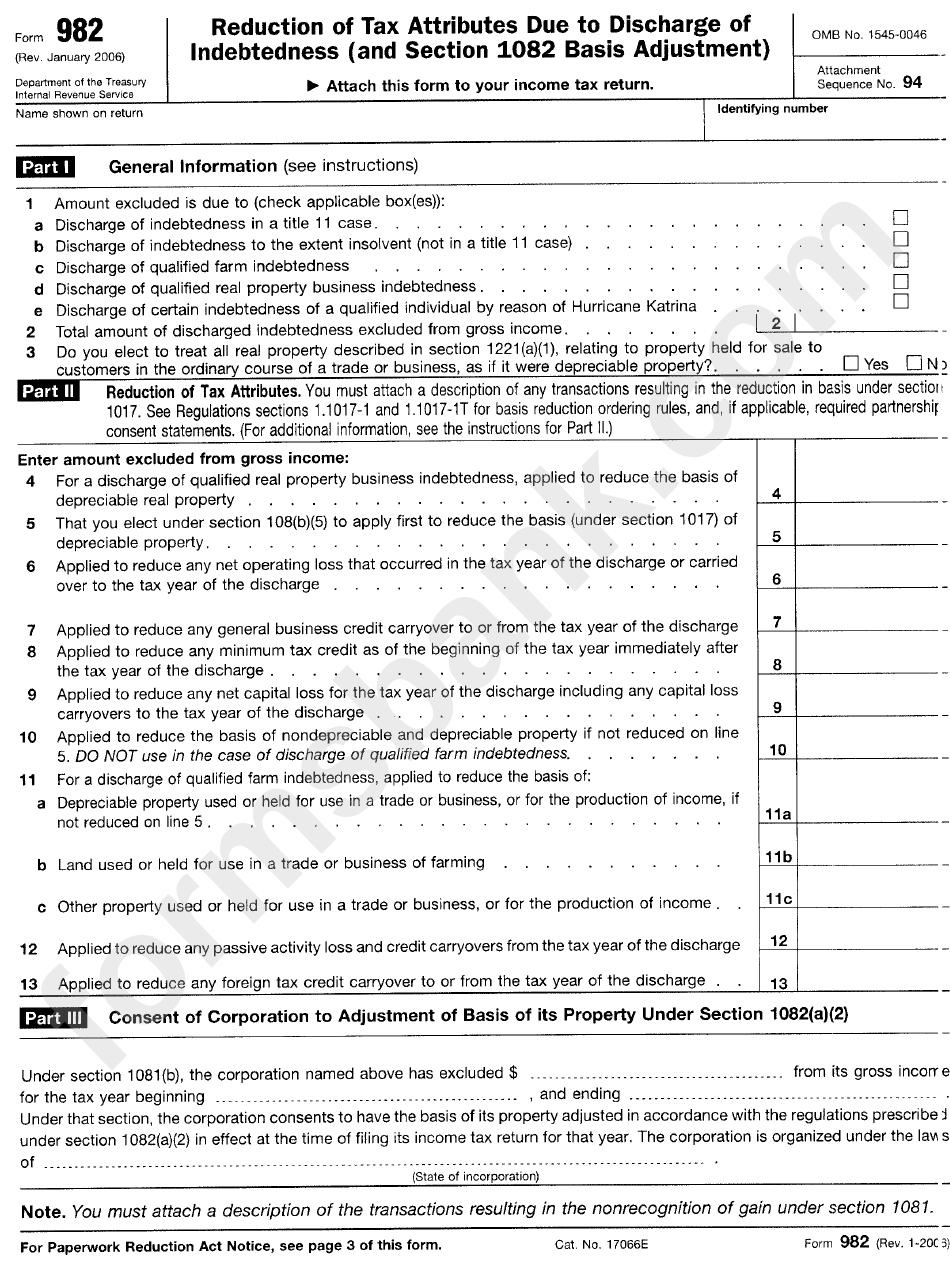

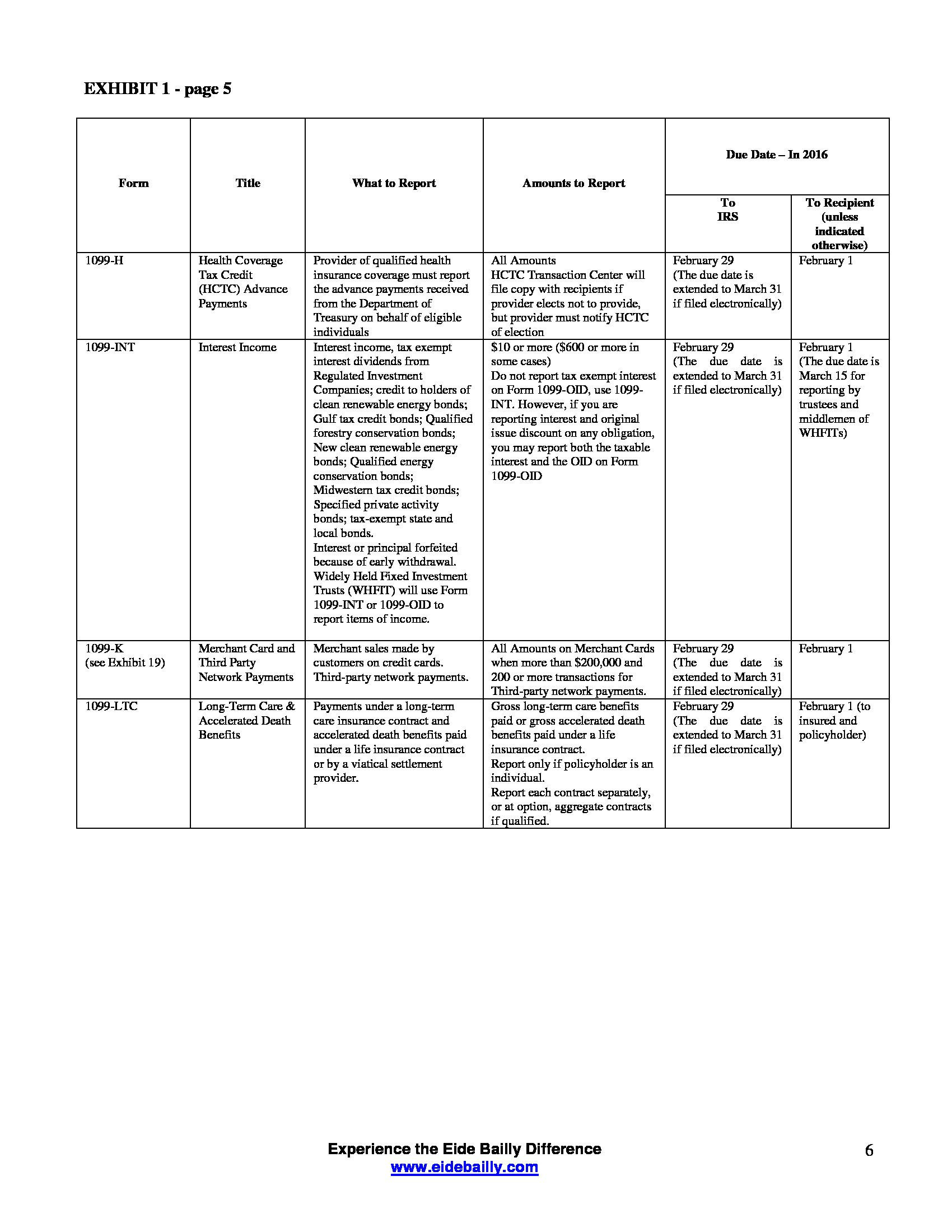

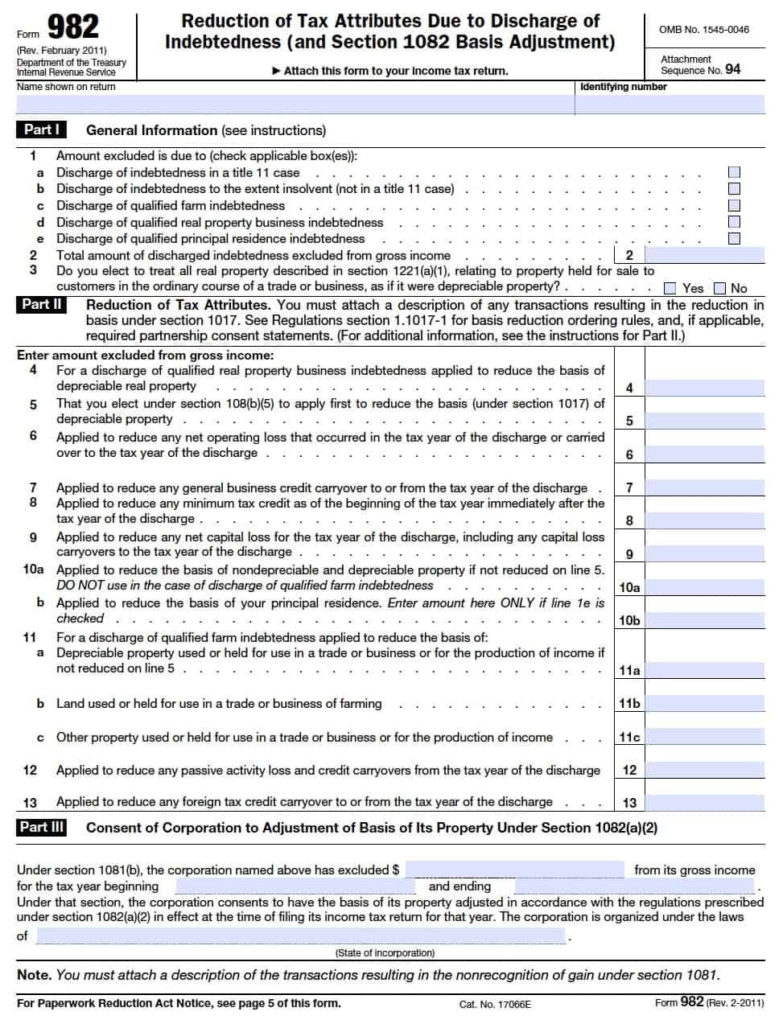

982 Tax Form - The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a).

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982).

Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982).

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to.

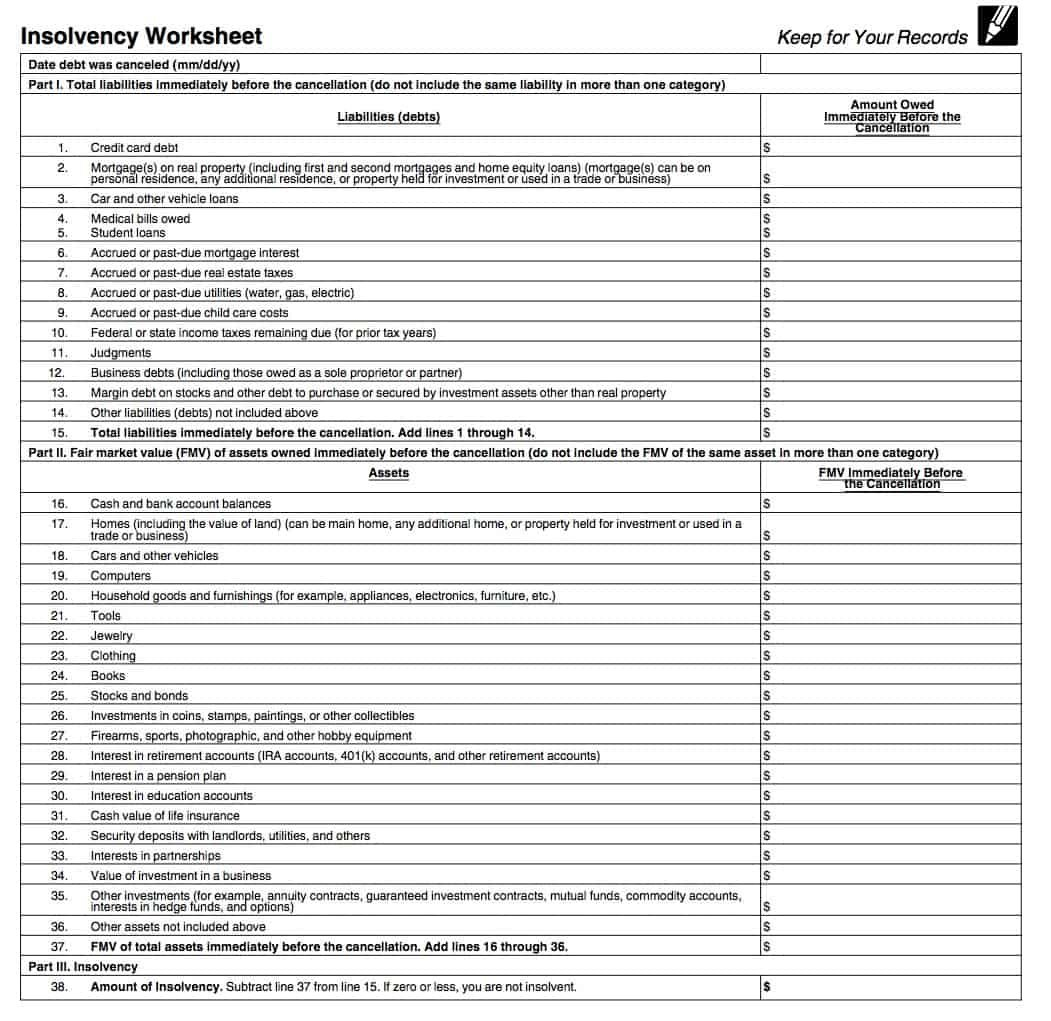

982 Tax Form Worksheets Library

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. The following articles are the top questions referring to reduction of tax attributes due to.

Tax Form 982 Insolvency Worksheet —

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to.

Form 982 IRS How to Reduce Your Tax Liability Through Debt Discharge?

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and.

Form 982 Insolvency Worksheet Printable Word Searches

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to.

Tax Form 982 Insolvency Worksheet — Db Free Download Nude Photo Gallery

The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from.

Tax Form 982 Insolvency Worksheet —

The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis.

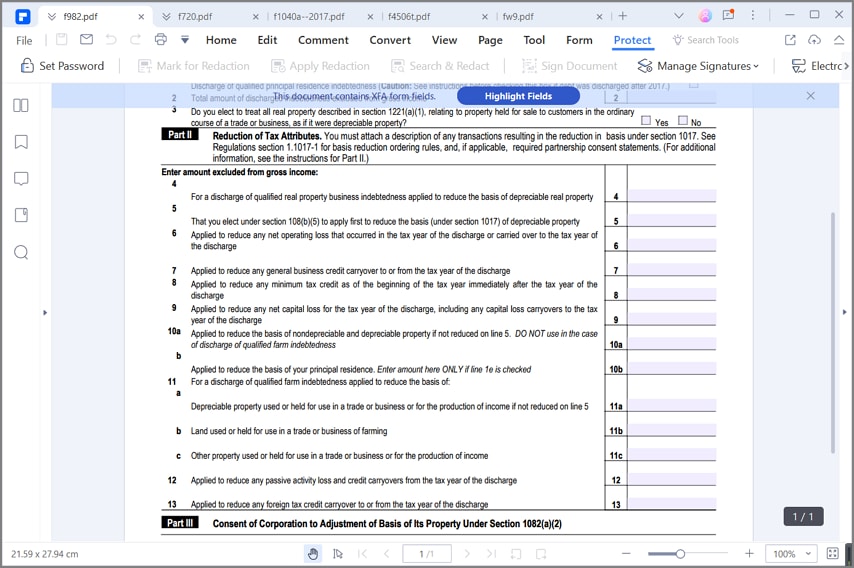

Pdf Fillable Irs Form 982 Printable Forms Free Online

Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness (form 982). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under.

Fillable Form 982 Reduction Of Tax Attributes Due To Discharge Of

Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. The following articles are the top questions referring to reduction of tax attributes due to discharge of indebtedness.

IRS Form 982 Instructions Discharge of Indebtedness

File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023). The following articles are the top questions referring to reduction of tax attributes due to.

The Following Articles Are The Top Questions Referring To Reduction Of Tax Attributes Due To Discharge Of Indebtedness (Form 982).

Form 982 is used to calculate the amount of discharged debt that can be excluded from gross income under section 108. File form 982 with your federal income tax return for a year a discharge of indebtedness is excluded from your income under section 108(a). Download or print the 2023 federal (reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment)) (2023).