12C Tax Form - Follow these steps & get a legal action plan if you need help. If you need to sign a return, the irs sends you this letter. A 12c letter means the irs needs more information to process your return. 12c is an identify verification letter. The irs will not say what generates a 12c letter but unusually large refund could do it. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the.

A 12c letter means the irs needs more information to process your return. Follow these steps & get a legal action plan if you need help. The irs will not say what generates a 12c letter but unusually large refund could do it. 12c is an identify verification letter. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. If you need to sign a return, the irs sends you this letter.

The irs will not say what generates a 12c letter but unusually large refund could do it. If you need to sign a return, the irs sends you this letter. A 12c letter means the irs needs more information to process your return. Follow these steps & get a legal action plan if you need help. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. 12c is an identify verification letter.

IRS 12C Letter More Info Needed to Process Tax Return Wiztax

The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. Follow these steps & get a legal action plan if you need help. 12c is an identify verification letter. If you need to sign a return, the irs sends you this letter. The irs will.

Irs Business Forms By Mail Joseph Pena's Template

If you need to sign a return, the irs sends you this letter. 12c is an identify verification letter. Follow these steps & get a legal action plan if you need help. The irs will not say what generates a 12c letter but unusually large refund could do it. A 12c letter means the irs needs more information to process.

What is form 12c Tax Meaning

If you need to sign a return, the irs sends you this letter. 12c is an identify verification letter. A 12c letter means the irs needs more information to process your return. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. Follow these steps.

Tax Rebate For Housing Loan Form No.12C Pallikalvi Teachers News

A 12c letter means the irs needs more information to process your return. Follow these steps & get a legal action plan if you need help. If you need to sign a return, the irs sends you this letter. The irs will not say what generates a 12c letter but unusually large refund could do it. 12c is an identify.

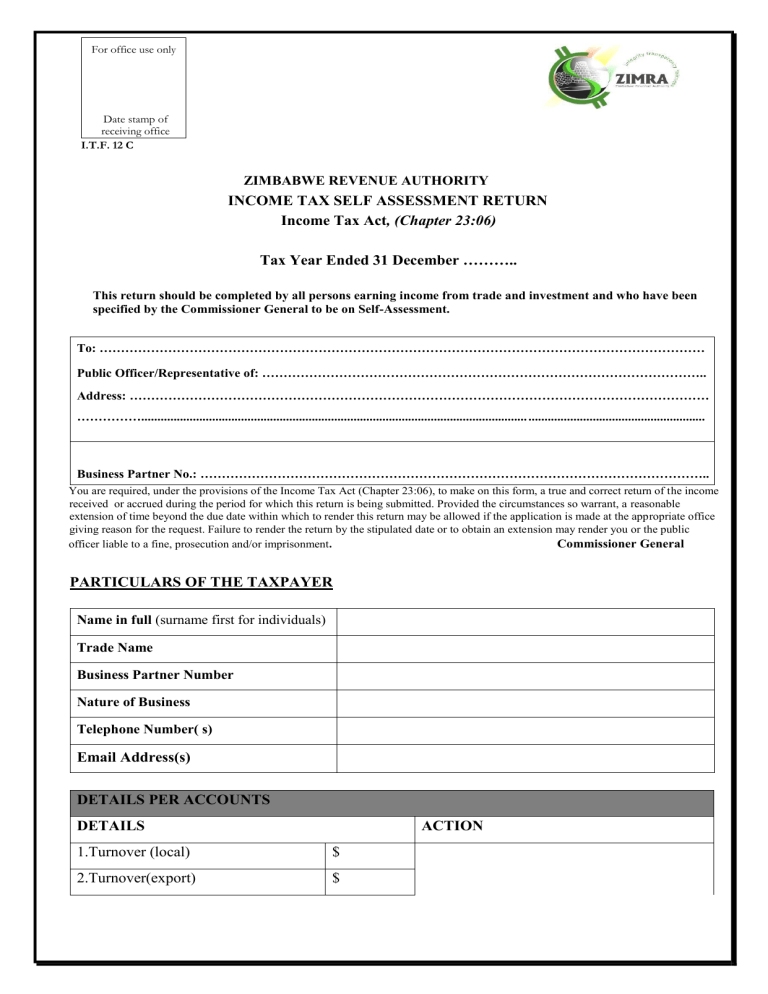

ITF 12C Tax Self Assessment Return

The irs will not say what generates a 12c letter but unusually large refund could do it. 12c is an identify verification letter. Follow these steps & get a legal action plan if you need help. A 12c letter means the irs needs more information to process your return. The irs issues letter 12c to inform a taxpayer that their.

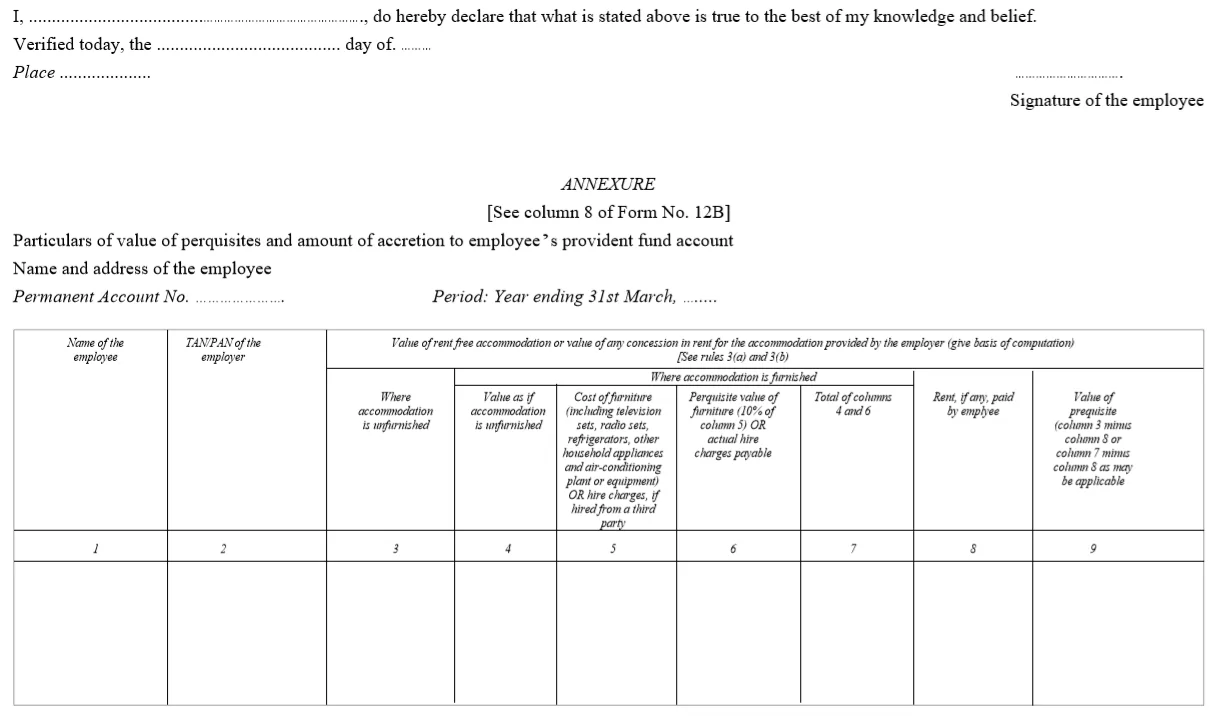

Form 12 Difference between Form 12B and 12BA in India

If you need to sign a return, the irs sends you this letter. 12c is an identify verification letter. The irs will not say what generates a 12c letter but unusually large refund could do it. A 12c letter means the irs needs more information to process your return. The irs issues letter 12c to inform a taxpayer that their.

Form 12c Sample Filled Complete with ease airSlate SignNow

The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. A 12c letter means the irs needs more information to process your return. 12c is an identify verification letter. Follow these steps & get a legal action plan if you need help. If you need.

What Is Form 12C In Tax Documentation?

The irs will not say what generates a 12c letter but unusually large refund could do it. A 12c letter means the irs needs more information to process your return. 12c is an identify verification letter. Follow these steps & get a legal action plan if you need help. If you need to sign a return, the irs sends you.

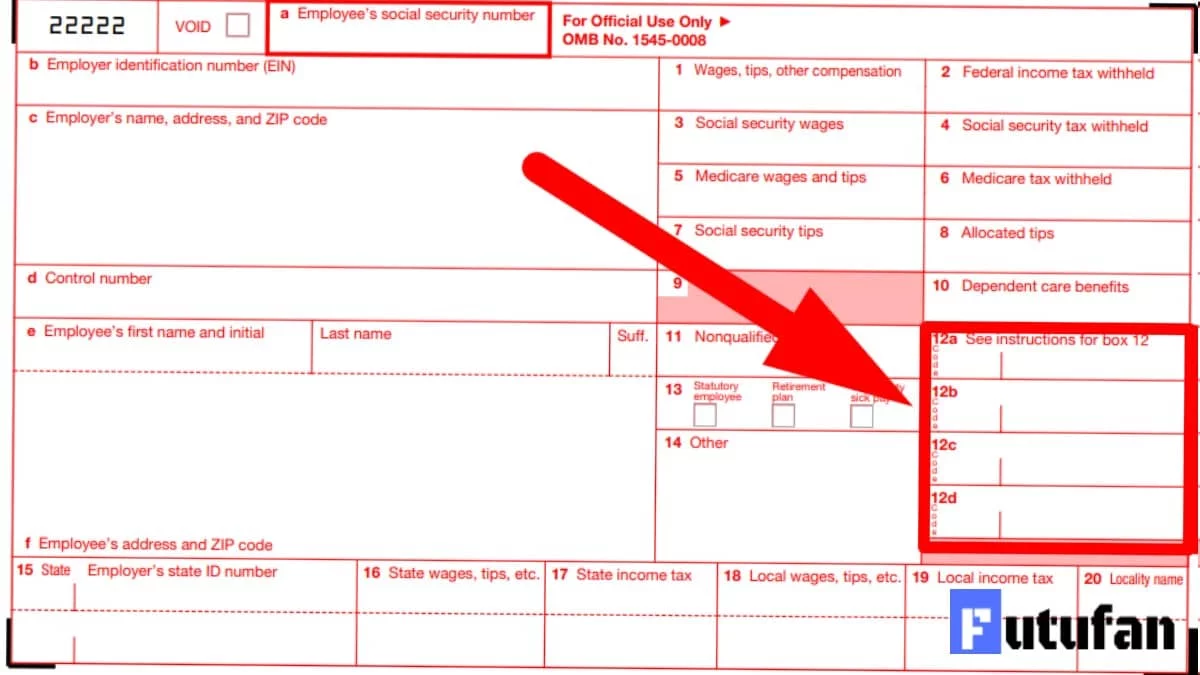

W2 12 Codes

The irs will not say what generates a 12c letter but unusually large refund could do it. If you need to sign a return, the irs sends you this letter. A 12c letter means the irs needs more information to process your return. 12c is an identify verification letter. The irs issues letter 12c to inform a taxpayer that their.

Property Tax Fact Sheet 12c, Understanding Your Assessment and

Follow these steps & get a legal action plan if you need help. If you need to sign a return, the irs sends you this letter. The irs will not say what generates a 12c letter but unusually large refund could do it. 12c is an identify verification letter. A 12c letter means the irs needs more information to process.

12C Is An Identify Verification Letter.

The irs will not say what generates a 12c letter but unusually large refund could do it. If you need to sign a return, the irs sends you this letter. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is needed in order to process the. A 12c letter means the irs needs more information to process your return.